Wealth Management For Tech Professionals

We help you make smart decisions with your stock options, RSUs and company stock + plan for your financial future

We're Experts in Stock Comp

Specialized knowledge to help you maximize the value of your equity compensation

In equity compensation advised

Liquidity events navigated

Stock comp plan optimizations

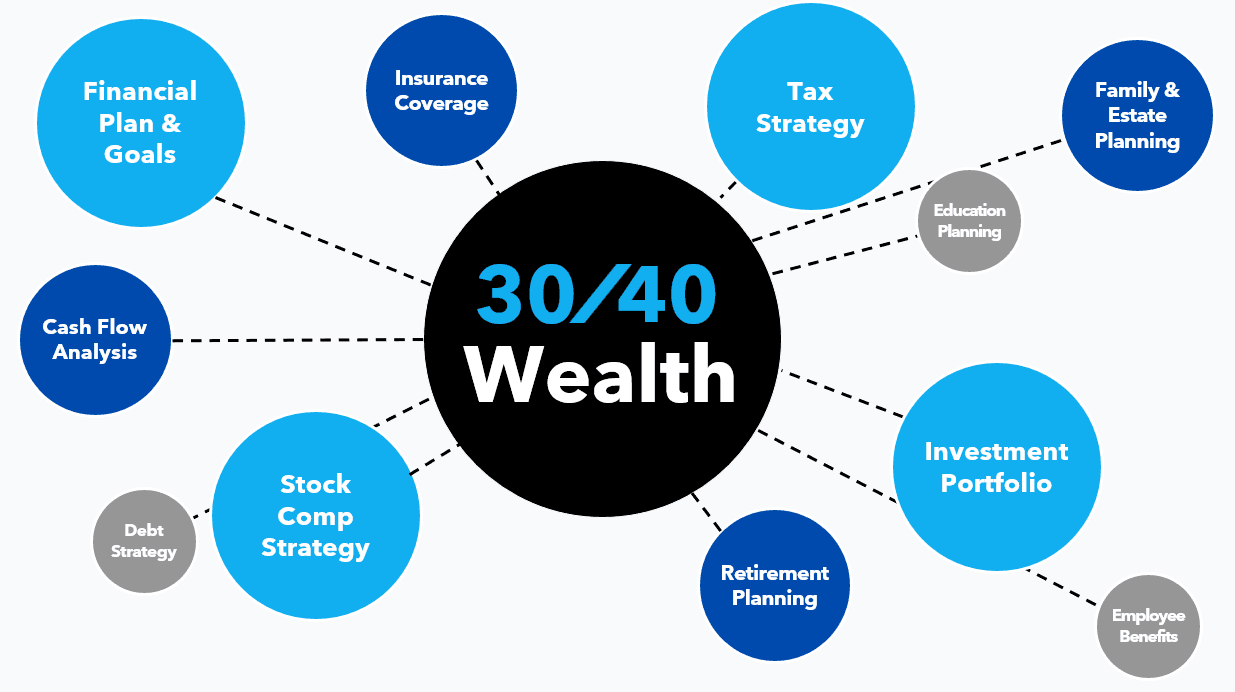

Custom Built for Tech Professionals

We understand the unique financial challenges and opportunities that come with working in tech.

Equity Compensation Expertise

Navigate stock options, RSUs, ESPP, and more with confidence

IPO and Exit Planning

Maximize your outcome during company transitions

Tax Optimization

Strategic planning to minimize your tax burden

Comprehensive Tax Strategy

We analyze 50+ tax strategies across 13 types of tax to ensure you don't overpay on taxes.

Multi-Year Tax Forecasts

Strategic planning across multiple years to minimize your tax burden

Equity Compensation Tax Strategies

Specialized approaches to minimize the tax impact on RSUs, ISOs, NSOs, stock, and more

Concentrated Stock & Liquidity Strategies

Sophisticated tools to manage concentrated stock, access liquidity, and optimize taxes—without taking unnecessary risk

Why Clients Choose Us

We're more than just an advisor. We're partners in your financial journey.

Proven Expertise

We've helped Clients optimize their equity comp through hundreds of situations.

Personal CFO Relationship

We help you overcome financial obstacles and make confident decisions about your future.

We See You Through It

From initial planning to execution, we're with you every step of the way.

Great and trustworthy advisor - puts clients first

I've worked with Kris for a number of years and have found him to be an exceptional financial adviso... read full review

Excellent, excellent service

Always thorough and detailed with his research and red commendations. Pushed us to diversify from a ... read full review

Fantastic service

Kris is an exceptional financial advisor. Kris is sharp, detail oriented, highly responsive, and gre... read full review

You will only regret not working with Kris -- knowledgable, exceptional advice...truly great

I've been working with Kris for nearly four years, and he's been an outstanding advisor throughout. ... read full review

Kris is the angel on your shoulder that everyone needs to have

Kris is great at working with the client, knowing their needs and goals, and crafting specific actio... read full review

Kris changed our perspective!

Kris helped us make a few big life decisions including moving back to the city we love as well as he... read full review

Could not recommend 30/40 more!

You will be hard pressed to find a better mixture of wealth management, career / industry advice, an... read full review

Confidence and Peace of Mind

Kris has helped give us confidence and peace of mind that our financial future is on the right track... read full review

Kris Is an Invaluable Partner

Kris goes above and beyond in every way. He works proactively on my behalf, always anticipating need... read full review

Great and trustworthy advisor - puts clients first

I've worked with Kris for a number of years and have found him to be an exceptional financial adviso... read full review

Excellent, excellent service

Always thorough and detailed with his research and red commendations. Pushed us to diversify from a ... read full review

Fantastic service

Kris is an exceptional financial advisor. Kris is sharp, detail oriented, highly responsive, and gre... read full review

You will only regret not working with Kris -- knowledgable, exceptional advice...truly great

I've been working with Kris for nearly four years, and he's been an outstanding advisor throughout. ... read full review

Kris is the angel on your shoulder that everyone needs to have

Kris is great at working with the client, knowing their needs and goals, and crafting specific actio... read full review

Kris changed our perspective!

Kris helped us make a few big life decisions including moving back to the city we love as well as he... read full review

Could not recommend 30/40 more!

You will be hard pressed to find a better mixture of wealth management, career / industry advice, an... read full review

Confidence and Peace of Mind

Kris has helped give us confidence and peace of mind that our financial future is on the right track... read full review

Kris Is an Invaluable Partner

Kris goes above and beyond in every way. He works proactively on my behalf, always anticipating need... read full review

About Us

30/40 Wealth was founded to address the unique financial needs of tech professionals. With years of experience in both finance and technology, we understand the complexities of equity compensation and the challenges of building wealth in the tech industry.

Our mission is to bring simplicity to equity compensation complexity and give you confidence in your financial path and plan.

Ready to Take Control of Your Financial Future?

Schedule a free consultation to discuss your unique financial situation and goals.